Services

Safe marketplace for electronic component

Fully cover you with Escrow services & AS 6081 Lab testing, for safe and successful transaction.

Enhanced counterfeit parts detection.

Mitigation of financial risks.

Regulatory compliance.

Simplified transaction process.

OUR PARTNERS

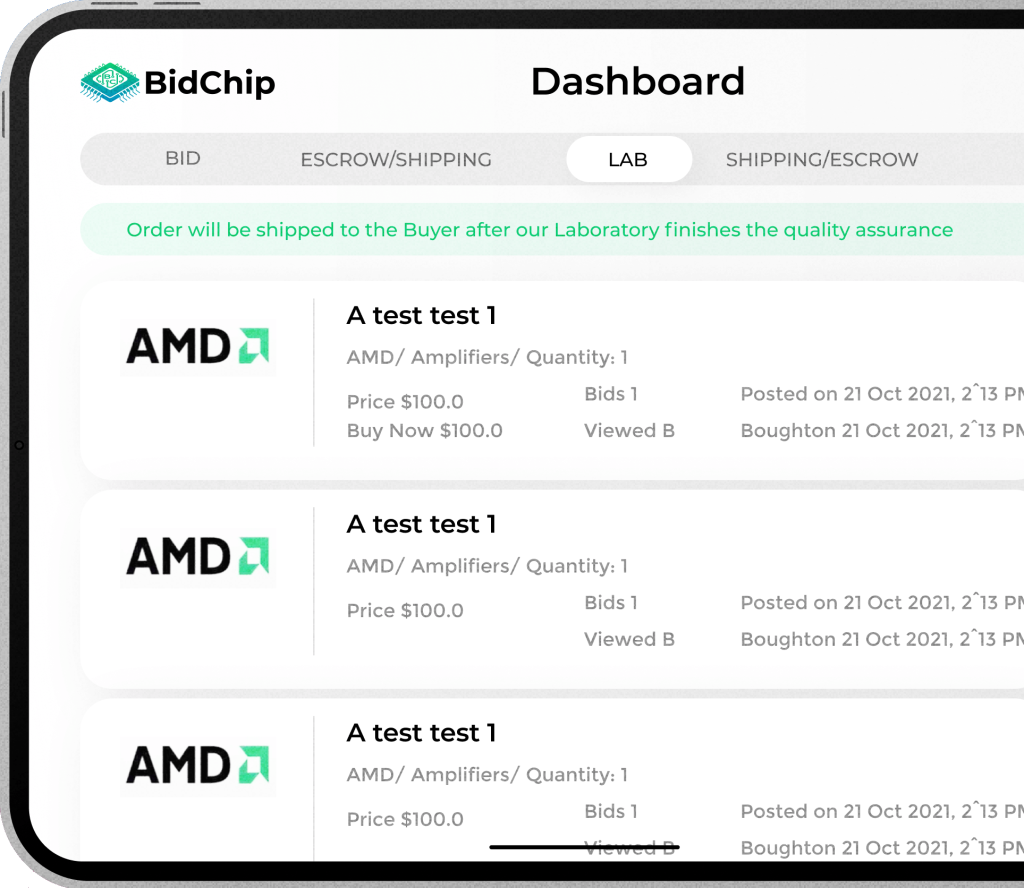

Bidchip

Bidchip empower Buyers and Suppliers to tread online without the fear of:

Counterfeit

Overdue-payment

Fraudulent transaction

Auction

Buyers

Seller

Quest

Buyers

Seller

Lab Test

Escrow

Improves your trading experience in four key areas

Streamline Trading

Save Time

Save Money

Increase Safety

Guide

Direction

Understand

We understand the frustration of not being able to trade freely.

Care

We don’t only care about parts; we care about your safety.

Discover

We discovered a way to win more projects safer, faster, and price effectively.

To learn more about please download our one page.

FAQ

Frequently asked questions

Escrow refers to a financial arrangement where a third party holds and manages funds or assets on behalf of two parties involved ina transaction. The primary benefit of using an escrow service is to provide security and mitigate risks for both the buyer and seller. Here are some key benefits of using escrow:

Security and trust: Escrow services act as neutral intermediaries, instilling confidence and trust between the parties involved in a transaction. Both the buyer and seller can be assured that their funds or assets are held securely until all the agreed-upon conditions are met.

Risk mitigation: Escrow minimizes the risk of fraud or misrepresentation in a transaction. By placing funds or assets in escrow, the buyer can ensure that they will only release payment once they have received the agreed-upon goods or services. Similarly, the seller can be confident that they will receive payment if they fulfill their obligations.

Dispute resolution: Escrow services often offer dispute resolution mechanisms. If a dispute arises between the buyer and seller, the escrow agent can step in to facilitate negotiations and reach a resolution. This can save time and money by avoiding lengthy legal proceedings.

Payment facilitation: Escrow services can simplify payment processes, especially in complex transactions. Instead of direct payment between parties, funds are transferred to the escrow account, and the escrow agent manages the distribution according to the agreed terms. This can streamline the payment process and reduce administrative burdens.

Compliance and regulatory adherence: Escrow services often have established processes and procedures in place to comply with relevant regulations, such as anti-money laundering (AML)and know-your-customer (KYC) requirements. Using an escrow service can help ensure that transactions adhere to these legal obligations.

Overall, escrow services provide a secure and trustworthy framework for conductingtransactions, protecting the interests of both buyers and sellers. By reducing risks, facilitatingpayments, and offering dispute resolution mechanisms, escrow services contribute to smootherand more reliable transactions in various industries.

Escrow refers to a financial arrangement where a third party holds and manages funds or assets on behalf of two parties involved ina transaction. The primary benefit of using an escrow service is to provide security and mitigate risks for both the buyer and seller. Here are some key benefits of using escrow:

Security and trust: Escrow services act as neutral intermediaries, instilling confidence and trust between the parties involved in a transaction. Both the buyer and seller can be assured that their funds or assets are held securely until all the agreed-upon conditions are met.

Risk mitigation: Escrow minimizes the risk of fraud or misrepresentation in a transaction. By placing funds or assets in escrow, the buyer can ensure that they will only release payment once they have received the agreed-upon goods or services. Similarly, the seller can be confident that they will receive payment if they fulfill their obligations.

Dispute resolution: Escrow services often offer dispute resolution mechanisms. If a dispute arises between the buyer and seller, the escrow agent can step in to facilitate negotiations and reach a resolution. This can save time and money by avoiding lengthy legal proceedings.

Payment facilitation: Escrow services can simplify payment processes, especially in complex transactions. Instead of direct payment between parties, funds are transferred to the escrow account, and the escrow agent manages the distribution according to the agreed terms. This can streamline the payment process and reduce administrative burdens.

Compliance and regulatory adherence: Escrow services often have established processes and procedures in place to comply with relevant regulations, such as anti-money laundering (AML)and know-your-customer (KYC) requirements. Using an escrow service can help ensure that transactions adhere to these legal obligations.

Overall, escrow services provide a secure and trustworthy framework for conductingtransactions, protecting the interests of both buyers and sellers. By reducing risks, facilitatingpayments, and offering dispute resolution mechanisms, escrow services contribute to smootherand more reliable transactions in various industries.

Avoid endless searches with low results due to the vetting process that limits you from winning the next project and risky transactions that can go wrong.

Imagine if you could trade parts with any buyer and seller.

For now, all you need to do is Click on:

AVOID FAILURE

AVOID FAILURE

You can stop:

Limiting your purchasing power by vetting suppliers, paying high prices, and losing projects.

And instead

Start to benefit from the Freedom to or (confidently) buy from any supplier at an affordable price without risk and win more projects. Your production line will never stop again.

Your production line will never stop again. Download our escrow elike service document.